I was anguished by the news reporting that Bank Indonesia's high ranking officers were proposing such a ridiculously large salary package! If the President and Vice President had asked for a salary raise, it would have been understandable.

On the last 13th Jan, the central bank of Indonesia announced its 9-step policy on Indonesia's banking for 2006 onward, containing 4 short-term and 5 medium- and long-term measures. In the short run, the measures aim to provide breathing space to the banking industry so as to continue playing a role in financing the development; in the medium- and long-term, it focuses to strengthen the banking foundation and elaborate on some of the programs contained in the Indonesias Banking Architecture, all of which are as follows:

1. BI is to review its PBI No.7/2/PBI/2005 concerning the Quality Assessment of Commercial Banks Assets, while holding dearly on the principle of prudence.

2. BI is to consider readjusting the minimum reserve ratio if macro stability so allows. The re-adjustment will be reviewed by the 1Q06 with a conviction that when the macroeconomic condition reaches a relatively stable level, banking liquidity can ease down.

3. BI is to keep increasing people's access to sharia banking services by allowing branches of conventional banks that already have sharia banking units, to provide office-channeling sharia transaction services so that banks no longer need to open new branches of their sharia units in many places before they can provide sharia services.

4. BI is to extend banking service network, particularly to the SME sector so as to reach out evenly to regional corners. Moreover, in the near future BI plans to adjust the ratio of weighted assets for certain retail activities, including the financing ratio to micro and small businesses.

5. BI is to strengthen the capital structure for expediting the process of banking consolidation. Referring to the PBI No.7/15/PBI/2005 concerning the minimum core capital requirement of commercial banks, indicatives to the effectiveness in the process of banking consolidation will be reflected in the first quarter of 2006, when action plans of the banks with capital under Rp100 billion are received by the central bank. BI will take necessary measures to ensure that the stipulation on the limits of banking activities be enforced if the PBI No.7/15/PBI/2005 cannot be met.

6. BI is to increase the role of foreign banking in the economy. The intermediary role of foreign banks currently needs to be improved. BI will improve the role of bankers by adopting policy guidelines related to the development of national-banking human resources so as to remain as competitive as that in international banking.

7. BI is to anticipate for the development of future banking. Referring to the trend within the industry that leads toward universal banking, BI is planning to embolden its position and directions in realigning for the relationship between banking and financial markets. Taking into account the possible consequences, the policy to open universal banking in Indonesia will be carried out selectively. BI will relate such operational permits to strict requirements that will reflect the soundness of a given bank in anticipating the risks that may ensue.

8. BI is to strengthen the banking sectors internal management. This gears towards resilience and competitiveness of each individual bank so that each can exist healthily to be profitable within individual peer group. Therefore, focus in the implementation of the conception of best practices that refer to banking efficiency and effectiveness as corporates in the future is by applying the principle of good governance and Basel II.

9. BI is to improve the infrastructure of the banking industry. In 2006, it will particularly strengthen 5 aspects: improvement of the financial sector safety net or JPSK (Jaring Pengaman Sektor Keuangan), establishment of apex institutions for rural banks, banking mediation institution, management of card-based oayment systems, and banking research institution in various regions in Indonesia.

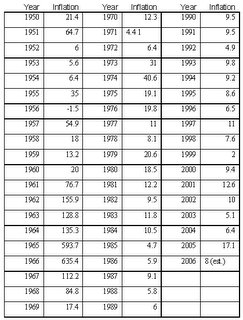

Indonesia's inflation since 1950

(Source: CBS, Indonesian Statistical Year Book, various editions.)

Bank Indonesia exists and is mandated by the law as an autonomous institution to adopt a single ultimate objective of reaching and maintaining the stability of the Rupiah currency. As stipulated in its charter, the stability here embraces two aspects: they are the stability of the Rupiah v-a-v the goods and services, and that v-a-v other currencies.

(Graph: Rupiah in the last 15 years; source: BI)

This stability here has everything to do with inflation, something most people regard as a "natural" phenomenon to adjust to while it is an elephant of a witness of a terribly imperfect, erronuous, manipulative, and manipulated financial arrangement in the world. Thus, like most central banks in the world, Bank Indonesia has existed to defend the indefensible. Its task has been an utter impossibility, something that cannot be attained as long as there is no reform in the global financial order. Until that happens, all central bankers need to be more sensible so as not to ask too much from the people.

No comments:

Post a Comment